A Slow Spiral

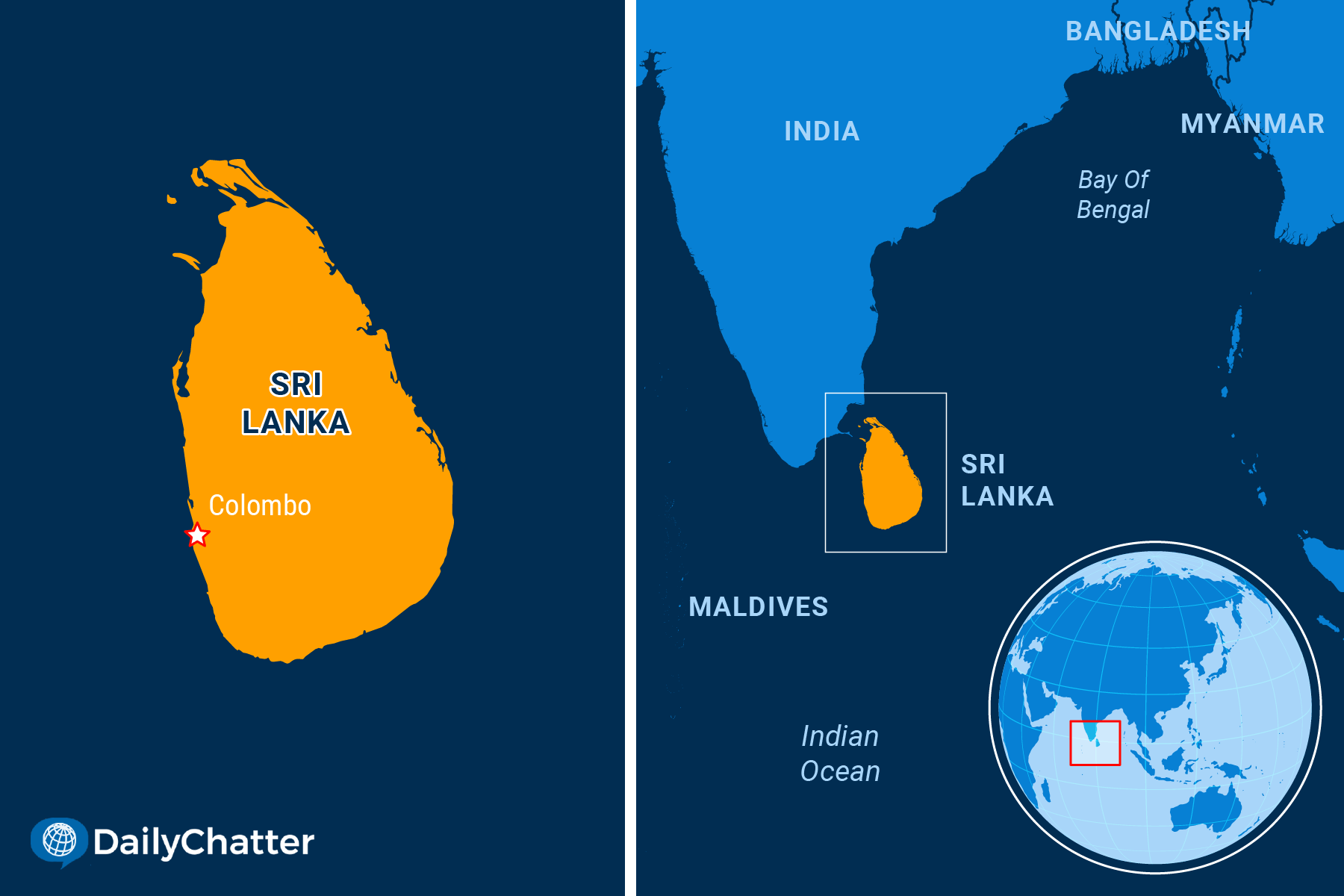

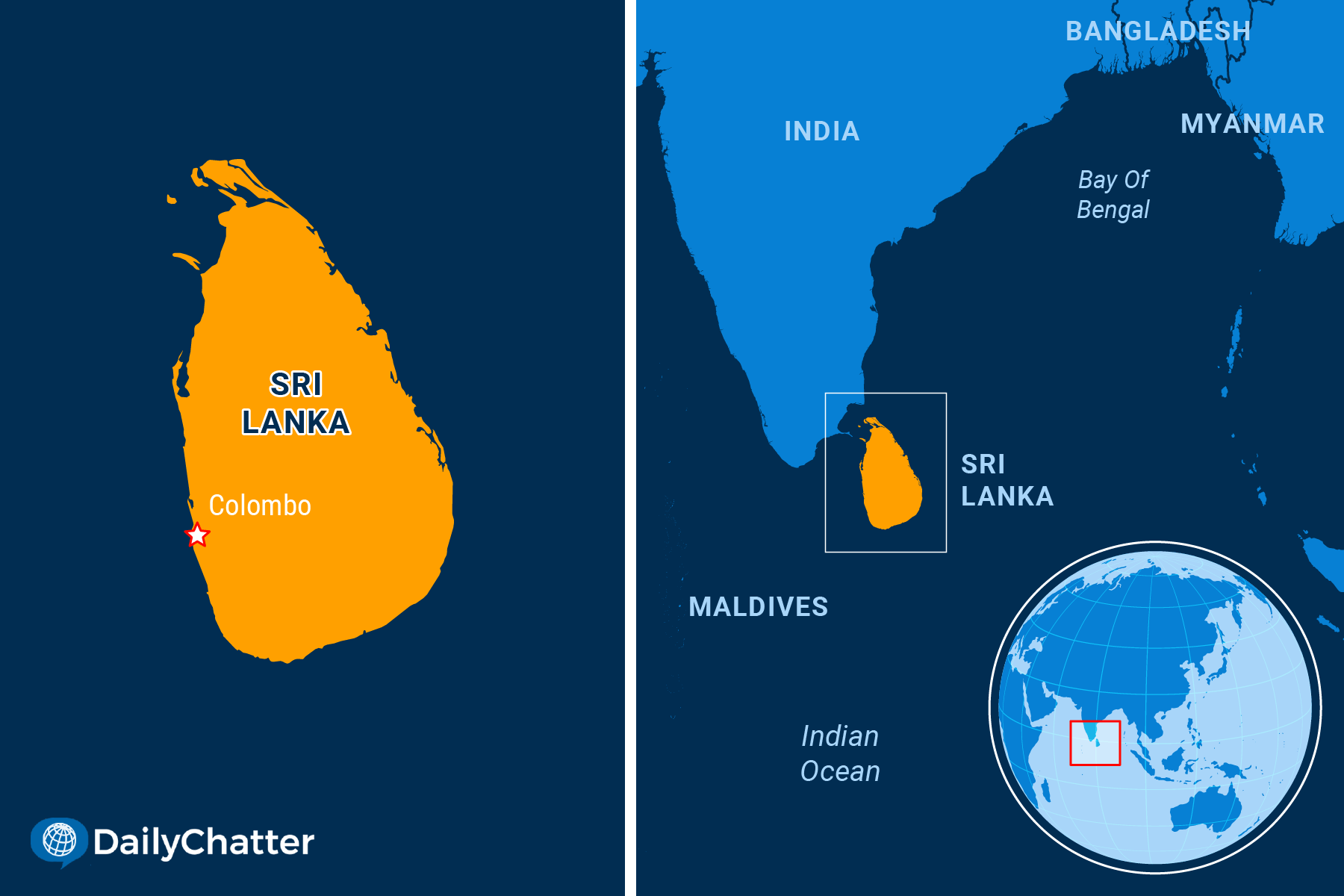

Thousands of Sri Lankans took to the streets of the capital, Colombo, this week to protest against the government’s handling of the economy, as the country faces a deepening economic crisis and potential debt default, the Financial Times reported.

Sri Lanka has for months faced a worsening economic situation including shortages of fuel, power blackouts and double-digit inflation.

Initially, the government said it would be able to handle the crisis without assistance from the International Monetary Fund. It has been securing funds from a post-pandemic revival in tourism and bilateral aid from other countries, such as neighboring India.

But investors’ skepticism and this week’s unrest prompted President Gotabaya Rajapaksa to begin talks with the IMF over a debt relief package.

Sri Lanka had debt and interest repayments worth about $7 billion due this year, and the country’s usable foreign currency reserves are estimated at $500 million.

One of the country’s most immediate issues is a $1 billion bond due in July, which many investors doubt the country will be able to repay without debt restructuring.

Sri Lanka is Asia’s largest high-yield bond issuer and has borrowed substantially in the years after the conclusion of its civil war in 2009.

It has never gone into default.

Subscribe today and GlobalPost will be in your inbox the next weekday morning

Join us today and pay only $32.95 for an annual subscription, or less than $3 a month for our unique insights into crucial developments on the world stage. It’s by far the best investment you can make to expand your knowledge of the world.

And you get a free two-week trial with no obligation to continue.