About-Face

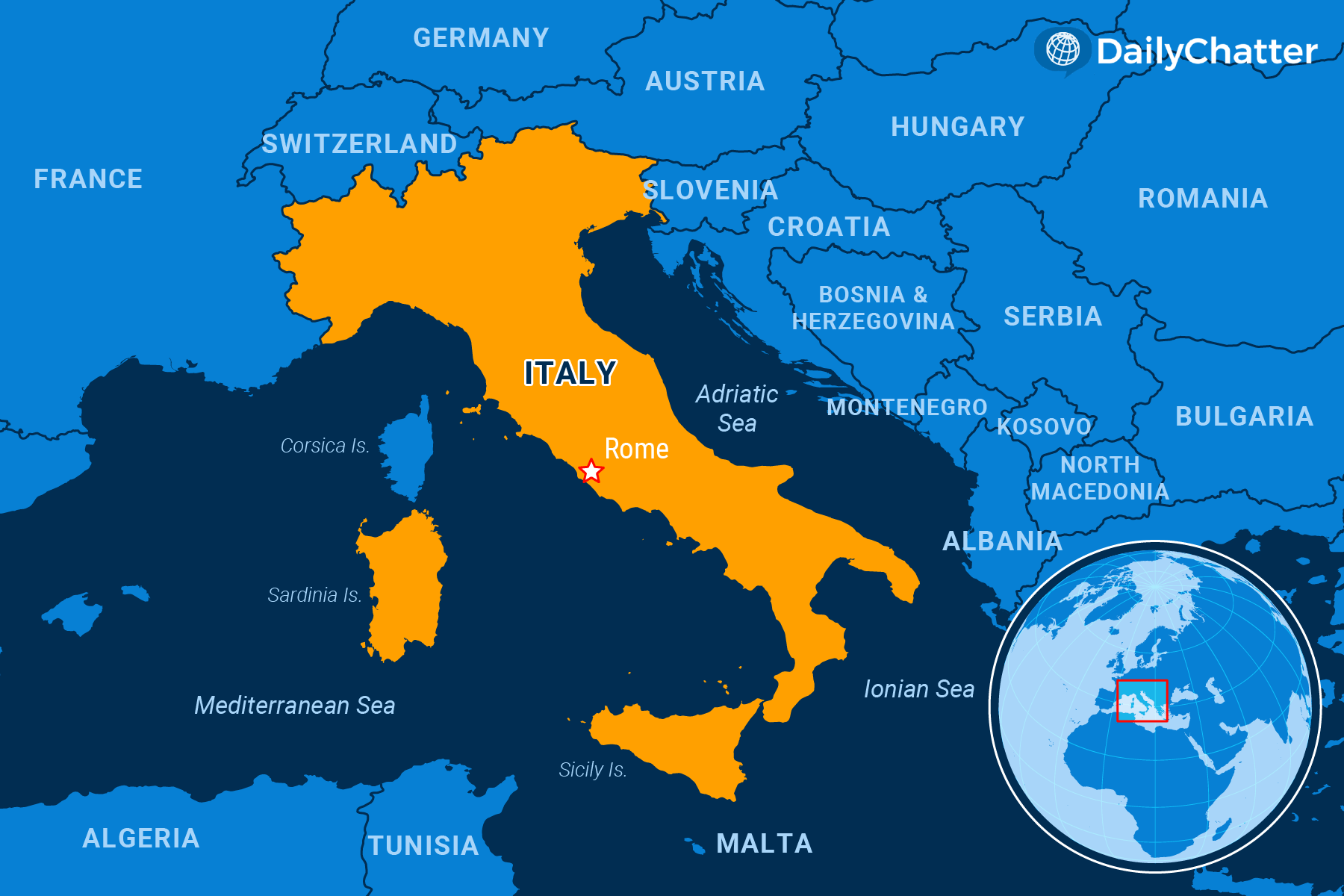

The Italian government’s imposition of a one-off 40 percent windfall tax on its banking sector, to help first-time homebuyers and cut taxes for families and businesses, caused chaos in the European markets, CNN reported Wednesday.

The announcement of the tax, which came earlier this week, caused shares in a number of banks throughout Italy and across Europe to plummet, wiping out nearly $10 billion from the market capitalization of the Italian banking sector, according to CNBC.

The shock prompted the government to backtrack on its plan, with officials saying that the levy would be capped at no more than 0.1 percent of a lender’s total assets “in order to safeguard the stability of the banks.”

Italian and European bank shares rebounded Wednesday following the government’s reversal.

Analysts told CNBC that the government expected “to raise more than $3 billion in tax but then the market realized that the numbers didn’t add up.”

They added, however, that the chaos created by the announcement would not have a lasting negative impact on market sentiment toward Italy’s banking sector.

In the past year, other European countries, such as Spain and the Czech Republic, have announced taxes on banks’ windfall profits as interest rate hikes by central banks have beefed up many lenders’ earnings.

Subscribe today and GlobalPost will be in your inbox the next weekday morning

Join us today and pay only $32.95 for an annual subscription, or less than $3 a month for our unique insights into crucial developments on the world stage. It’s by far the best investment you can make to expand your knowledge of the world.

And you get a free two-week trial with no obligation to continue.