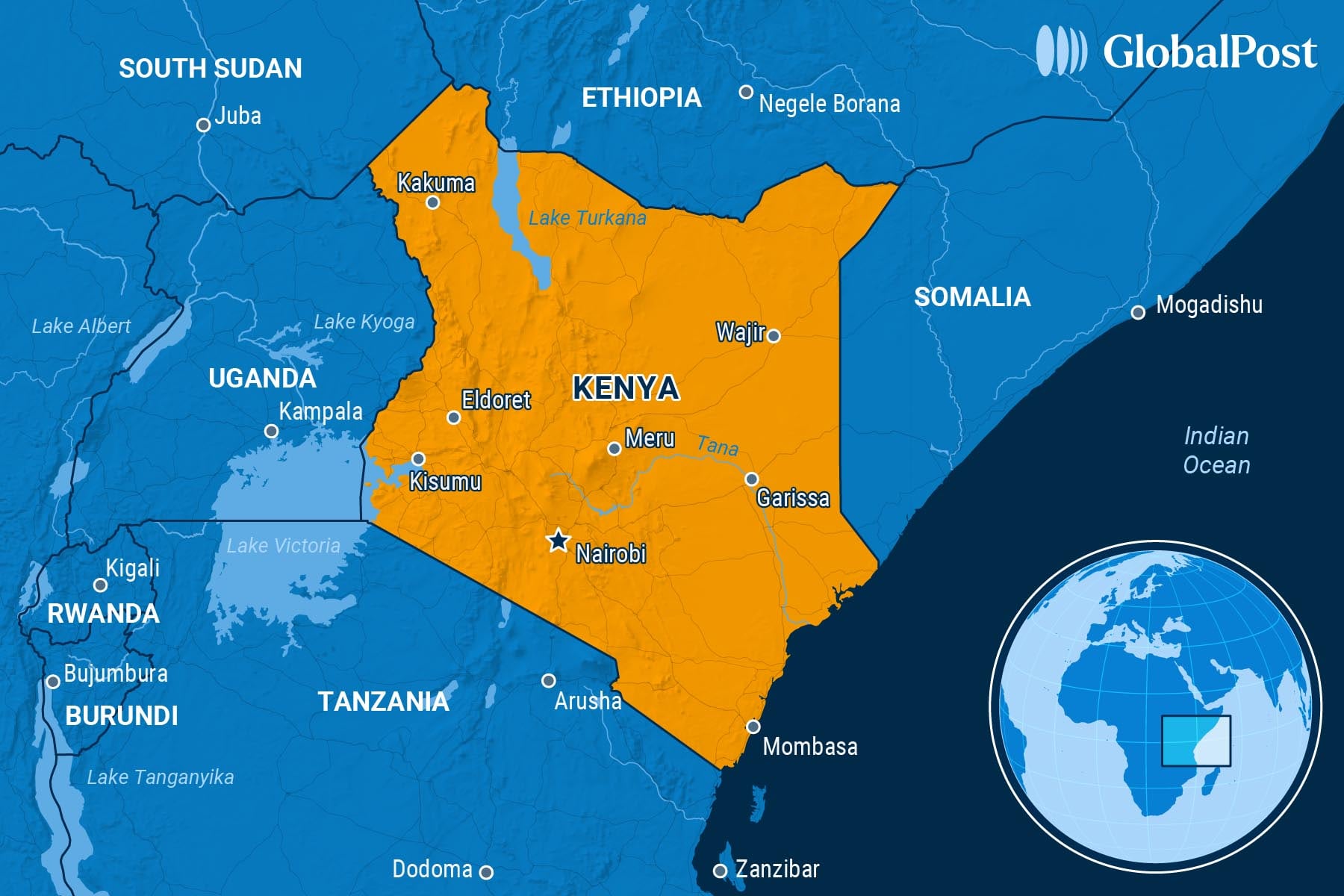

Bitcoin Dreams: In Kenya’s Largest Slum, Residents Hope For a Crypto Lift

In Africa’s largest slum, Kibera, Dotea Anyim, like dozens of her fellow residents, has a small produce stand. But unlike most others, she accepts bitcoin, which about 10 percent of her customers use now.

“I like it because it is cheap and fast and doesn’t have any transaction costs,” she told the Associated Press. “When people pay using bitcoin, I save that money and use cash to restock vegetables.”

Around the world, people, businesses – and even entire countries – are adopting cryptocurrencies as a tool to combat poverty and grow revenue in spite of their risks, namely volatility and the lack of regulation.

“Bitcoin presents new opportunities for those in emerging economies, providing the freedom to transact without any gatekeepers,” wrote the European Conservative. “Through bitcoin, anyone can now enter the wider global economy and marketplace, and have the chance to be lifted out of poverty.”

Bitcoin, the first and largest cryptocurrency, was created in 2009 in the wake of the global financial crisis as a decentralized digital asset that could serve as an alternative method of payment, storing value as well as earning it.

Since then, it has taken off. It has helped those in war zones access their funds and the poor around the world get access to financial services they are often shut out from. It’s helped families get remittances from relatives abroad more easily and cheaply, and given the poor a chance to accrue savings and invest.

It was also adopted as legal tender in some countries, such as El Salvador and the Central African Republic, before both of those countries halted the move. Others, such as Bhutan, are ramping up their use of the currency.

Here in Kibera – a part of the capital of Nairobi with a population ranging from 250,000 to 1 million, no one is certain – a few hundred merchants and shoppers so far are using bitcoin as part of a pilot program to extend financial services to some of the country’s poorest and most under-banked people.

Kibera residents earn a dollar a day on average.

In Kenya overall, about 55 percent have access to financial institutions such as banks, a far higher percentage than in many other countries on the continent, such as Senegal, with only about 20 percent, according to the World Bank.

But far more people have access to a cell phone.

As a result, supporters of bitcoin say that it is accessible to those “unbanked” who are often prevented from accessing banks because they lack the proper documents or the money to obtain accounts.

The pilot program, started by AfriBit Africa, a Kenyan fintech company, in 2022, began with garbage collectors, who were paid in crypto and taught financial literacy and “Bitcoin 101.” The practice since then has slowly started to spread to other businesses that serve the slum.

“Bitcoin solves issues of financial sovereignty and financial inclusion,” Ronnie Mdawida, director of the AfriBit project, told Forbes. “Some of the merchants in the community do not have any form of documentation and would not be able to participate in the traditional business ecosystem or build their lives without bitcoin, which offers them an alternative.”

For years, the unbanked used M-PESA, the most used mobile money program in Kenya. However, advocates say one advantage of bitcoin over M-PESA is that the latter’s transaction costs are higher. If consumers and merchants use the AfriBit Africa platform, transactions are free.

Another issue is crime: Carrying cash is risky in Kibera, residents say.

One major risk of using the currency is the exposure to bitcoin’s volatility – some of Kenya’s poorest bitcoin users hold up to 80 percent of their net worth in the cryptocurrency, money they can’t afford to lose.

Also, there are barriers to access: Users need smartphones, consistent Internet, and digital literacy – all of which remain scarce in informal settlements like Kibera.

Meanwhile, there is regulatory uncertainty: Kenya’s government is planning to introduce a digital asset tax and restrictions on crypto giveaways which could harm users here.

“Bitcoin isn’t a silver bullet,” one Kenya fintech strategist told BitKE, a Kenyan magazine covering crypto. “If we can’t prove sustained usage or economic impact, this becomes a charity stunt – not financial inclusion.”

Subscribe today and GlobalPost will be in your inbox the next weekday morning

Join us today and pay only $46 for an annual subscription, or less than $4 a month for our unique insights into crucial developments on the world stage. It’s by far the best investment you can make to expand your knowledge of the world.

And you get a free two-week trial with no obligation to continue.