No Cards Accepted

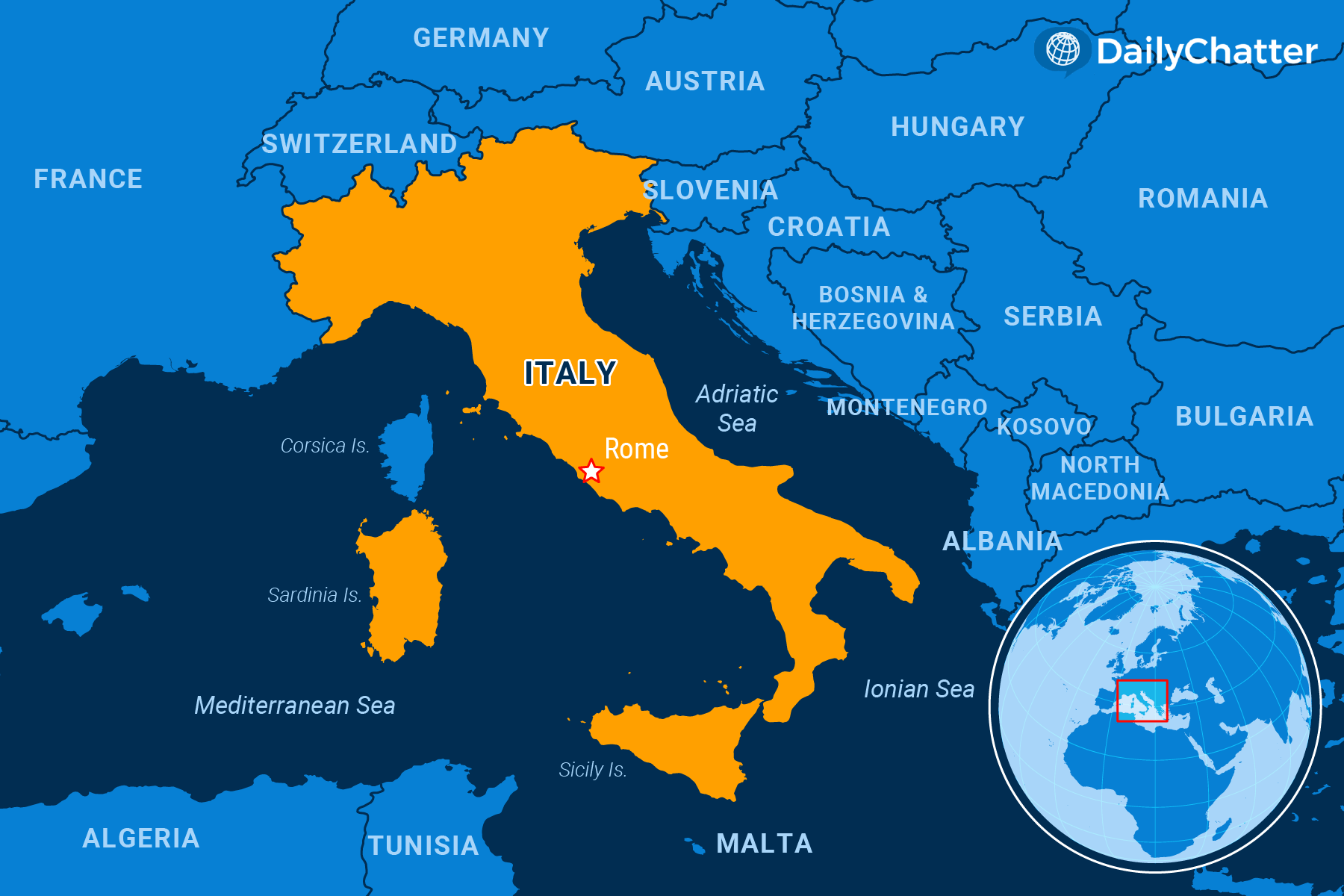

Over the last decade, Italian authorities have opened new fronts in the battle against tax cheats, including scouring posh Alpine ski resorts for the owners of Lamborghinis and Maseratis claiming poverty wages on their tax returns. They used special canine units to sniff out bags of cash crossing the border to Switzerland, and gained court orders to search safe deposit boxes suspected of holding illicit jewels.

Tax evasion has long been a problem in Italy, which has a large black market economy – some estimates say it accounts for more than a fourth of the country’s GDP – and that’s part of the reason it is among the world’s most indebted countries.

But when it came to reducing the role of cash in the Italian economy, Italy was ahead of the game. Italy’s first statute on money laundering, indeed the first in Europe, took effect in 1978. Sure, it was aimed at fighting the Mafia’s money-laundering operations, but it also helped limit tough-to-trace cash transactions.

“There was a time when other countries studied Italy’s money-laundering statutes,” Javier Noriega, senior economist with Milan-based investment bankers Hildebrandt and Ferrar told DailyChatter. “Cash had long been king for smaller transactions but it became more difficult to plop down a big box of cash to buy property or a car.”

The laws that started out with a cap of 1,000 euros ($1,061) on cash transactions eventually included the near-elimination of fees for small bank card transactions. Slower than in other European countries, Italians started using credit cards for even the smallest payments. The credit card penetration rate is now expected to surpass 50 percent next year, according to Statista.

“I remember the first time someone pulled out a bank card to pay for a cup of coffee,” Antonino Gattuso, a coffee bar owner in Rome where a cup of espresso costs 1.10 euros, said in an interview. “I thought they were crazy. But it’s become more and more common, especially with young people.”

But the newly installed Italian government, led by nationalist Prime Minister Giorgia Meloni, is taking steps to reverse some of the changes. Earlier this year, lawmakers doubled the cap on cash transactions to 2,000 euros. And last month, the Meloni government raised it again, to 5,000 euros. According to Italian media reports, the original plan had been to raise it to 10,000 euros.

Meloni says there’s little evidence that connects a greater use of cash to tax evasion. Instead, she explains the move back toward cash is designed to boost poor Italians and mom-and-pop businesses that might have less access to digital payment methods.

In fact, Meloni even wanted to include a measure in the country’s 2023 budget to allow vendors to refuse bank cards for purchases under 60 euros. But that move was criticized by European Union officials who set conditions on its grants and loans, Bloomberg noted, due to worries about tax evasion and other financial crimes. Earlier this month, it was removed from the budget bill, Italian news agency ANSA reported.

Italy’s initial fight against money laundering started more than 50 years ago after Italian crime families started growing beyond their traditional businesses of extortion, intimidation, smuggling, and prostitution. Their new ground involved vying for bloated public contracts and forcing their way into real-estate deals, areas that required buying influence among the political class – and that required large amounts of untraceable cash.

“When people talk about fighting the Mafia’s influence they talk about capturing crime bosses and dramatic raids,” said Sergio Nazzaro, an Italian journalist and author specializing in organized crime in an interview. “But (the focus) should be (on) banks and the processes that make it possible for the Mafia to do what it does. That’s where the anti-money laundering rules come in.”

Organized crime has mostly adapted to the changes in the rules over recent decades, and few think the raised cash limits will impact on the mob’s reach. But the reasoning behind the changes is still unclear. According to one analyst, the motives are almost surely political.

Meloni became Italy’s first-ever female prime minister by championing controversial views critical of the euro currency, refugee policies, the EU, and NATO. But since then, she’s moved toward the center, taking mainstream views aimed at sparking economic growth, curbing inflation, and keeping the lights on.

The moves toward cash are simply aimed at appealing to Meloni’s base, a group that might lose patience with the measured, centrist governing style from their long-time firebrand, says Oreste Massari, a political science professor at Rome’s La Sapienza University.

“She has to give something to supporters who complain about big business having a hand in everything,” he told DailyChatter. “Knowing that a multinational bank isn’t involved in their morning coffee bar transaction, it means something.”

— Eric J. Lyman, Rome, Italy, for DailyChatter

Subscribe today and GlobalPost will be in your inbox the next weekday morning

Join us today and pay only $32.95 for an annual subscription, or less than $3 a month for our unique insights into crucial developments on the world stage. It’s by far the best investment you can make to expand your knowledge of the world.

And you get a free two-week trial with no obligation to continue.