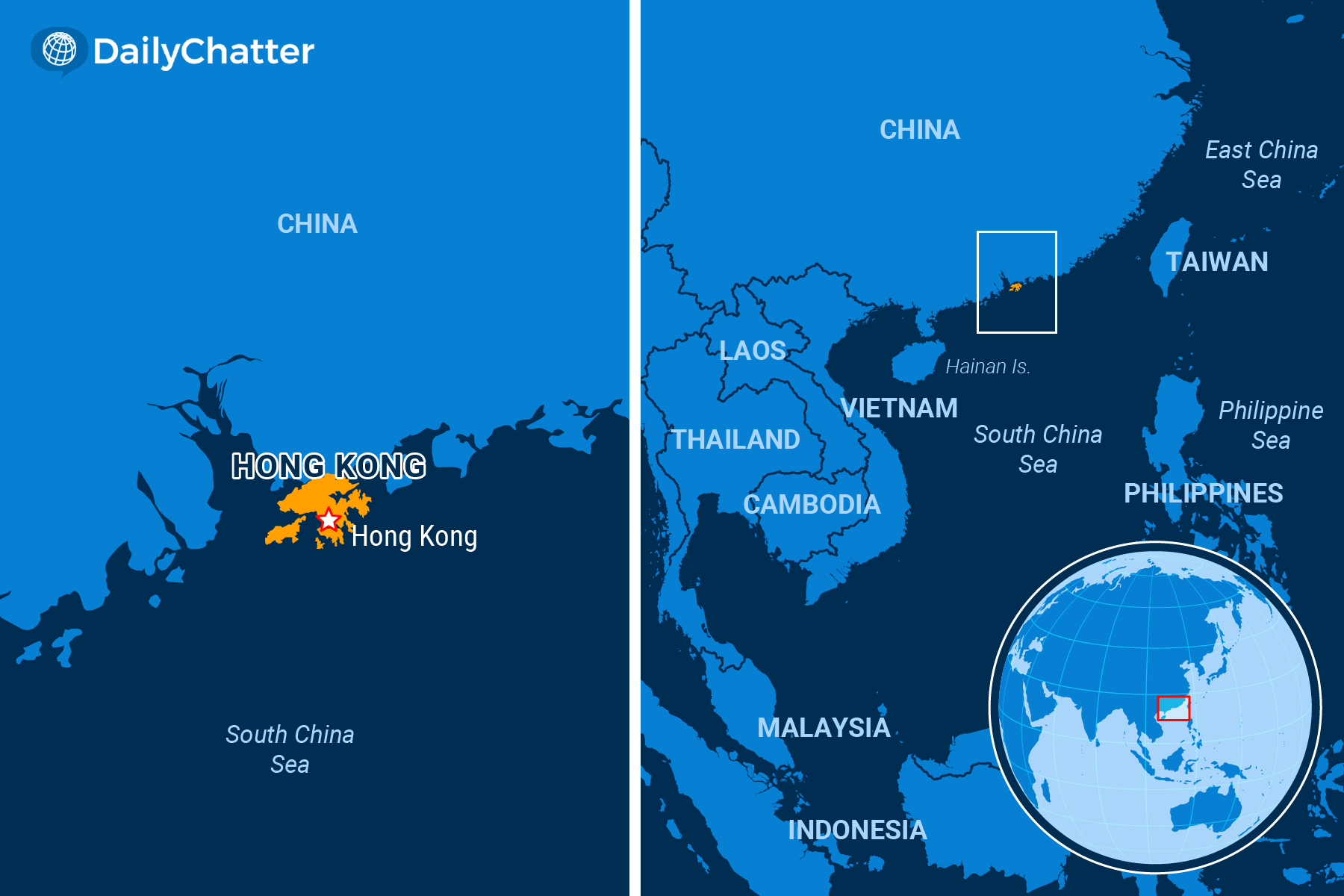

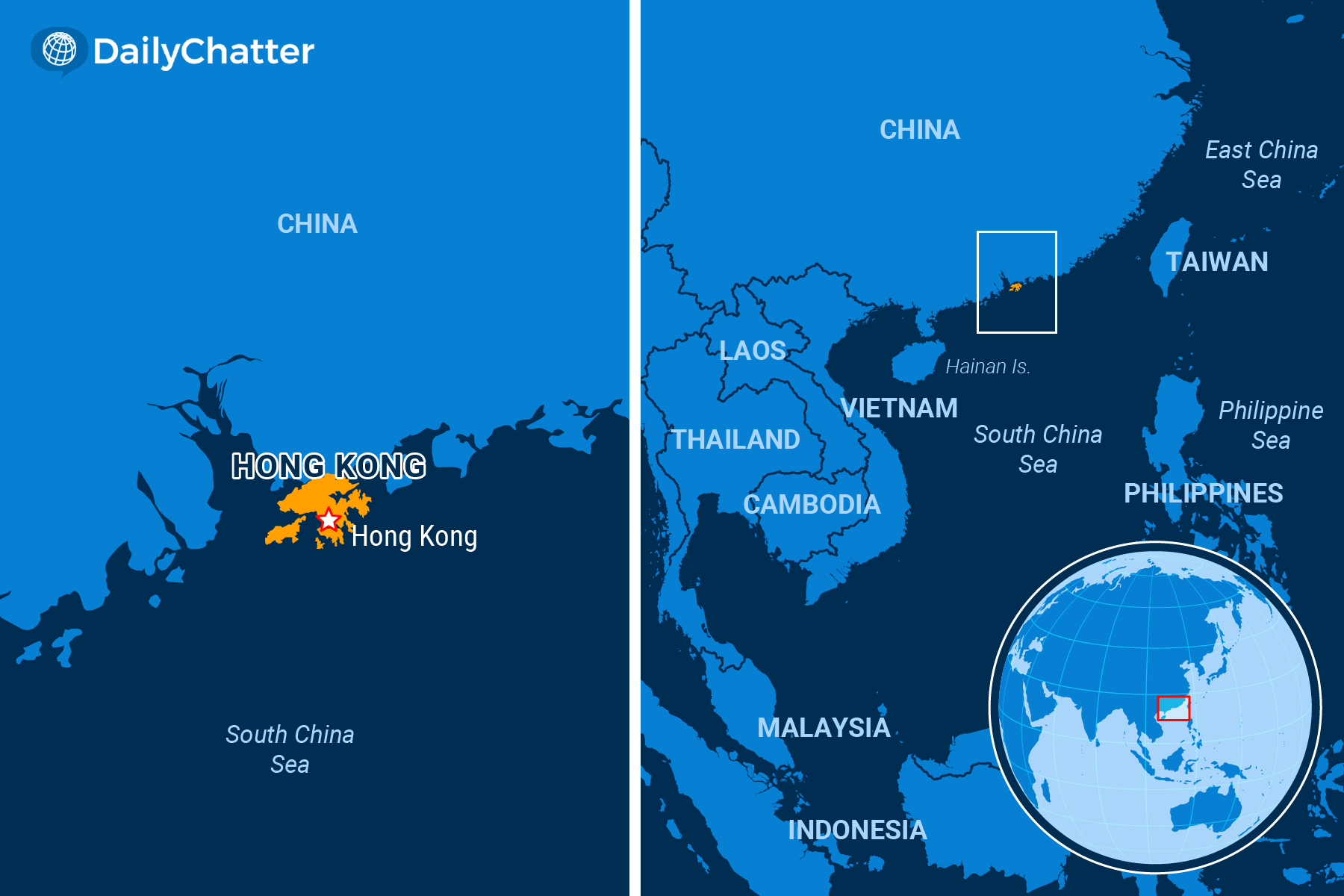

One Country, One Economy

A Hong Kong court ordered Chinese real estate giant Evergrande to liquidate its assets on Monday after the company failed to restructure its $300 billion debt, a blow to a sector hit by crackdowns, crises, and investor hesitancy, and one that could impact the already slowing Chinese economy, the Associated Press reported.

China Evergrande defaulted in 2021, one year after the government cracked down on borrowing by property developers in an effort to address the country’s slowing economic growth. The decision led the sector into crisis, and dozens of companies collapsed.

Court documents on Monday said Evergrande is “grossly insolvent and is unable to pay its debts.” After initially allowing the company a postponement of the liquidation order in December, the judges established it had failed to provide a viable plan to restructure its debt and concluded, “Enough is enough.”

In the face of Evergrande’s slow-paced trouble-shooting efforts, the court argued that their verdict was in the best interest of creditors.

However, it’s still unclear how it will impact stakeholders, including families who invested their life savings in housing projects Evergrande has so far failed to complete.

Meanwhile, Evergrande’s Hong Kong shares dropped by 21 percent on Monday before they were removed from trading. This came after India’s stock market overpassed Hong Kong last week and claimed the former British colony’s fourth place worldwide.

Reacting to the court’s liquidation order, Evergrande CEO Shawn Siu expressed his “utmost regret” but noted that the verdict only affected the company’s Hong Kong branch.

Observers argued that it would have little immediate effect in mainland China, where Evergrande has 90 percent of its operations, though Chinese courts can recognize Hong Kong bankruptcy rulings.

Nonetheless, the court’s decision is the latest red flag to foreign investors, who have already moved billions of dollars out of China. The country’s real estate boom, once a preeminent venue for foreign investment, pushed its total debt to more than 300 percent of annual economic output, a number that is unusually high for a country with China’s economic profile.

Subscribe today and GlobalPost will be in your inbox the next weekday morning

Join us today and pay only $32.95 for an annual subscription, or less than $3 a month for our unique insights into crucial developments on the world stage. It’s by far the best investment you can make to expand your knowledge of the world.

And you get a free two-week trial with no obligation to continue.