Sprinting Ahead

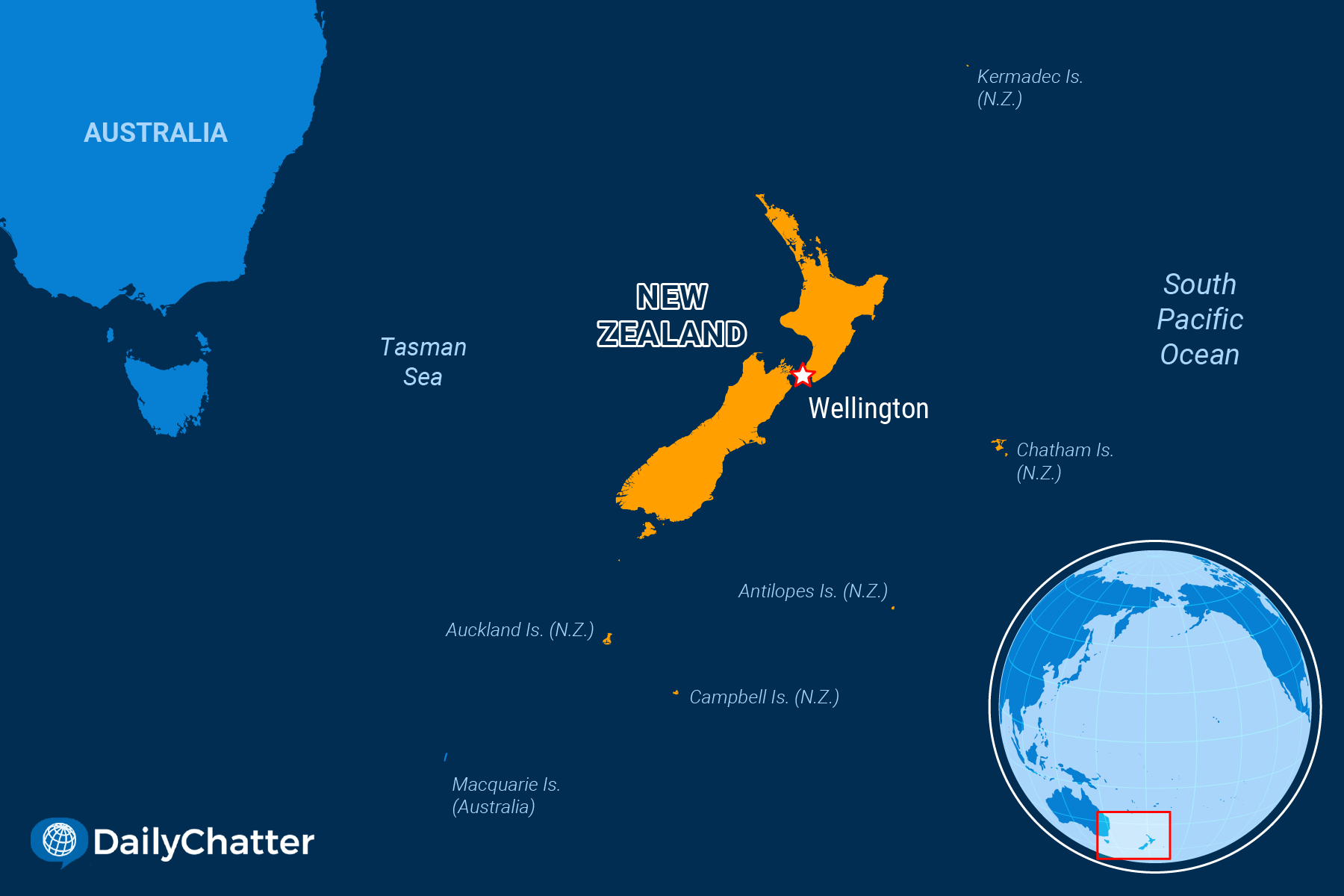

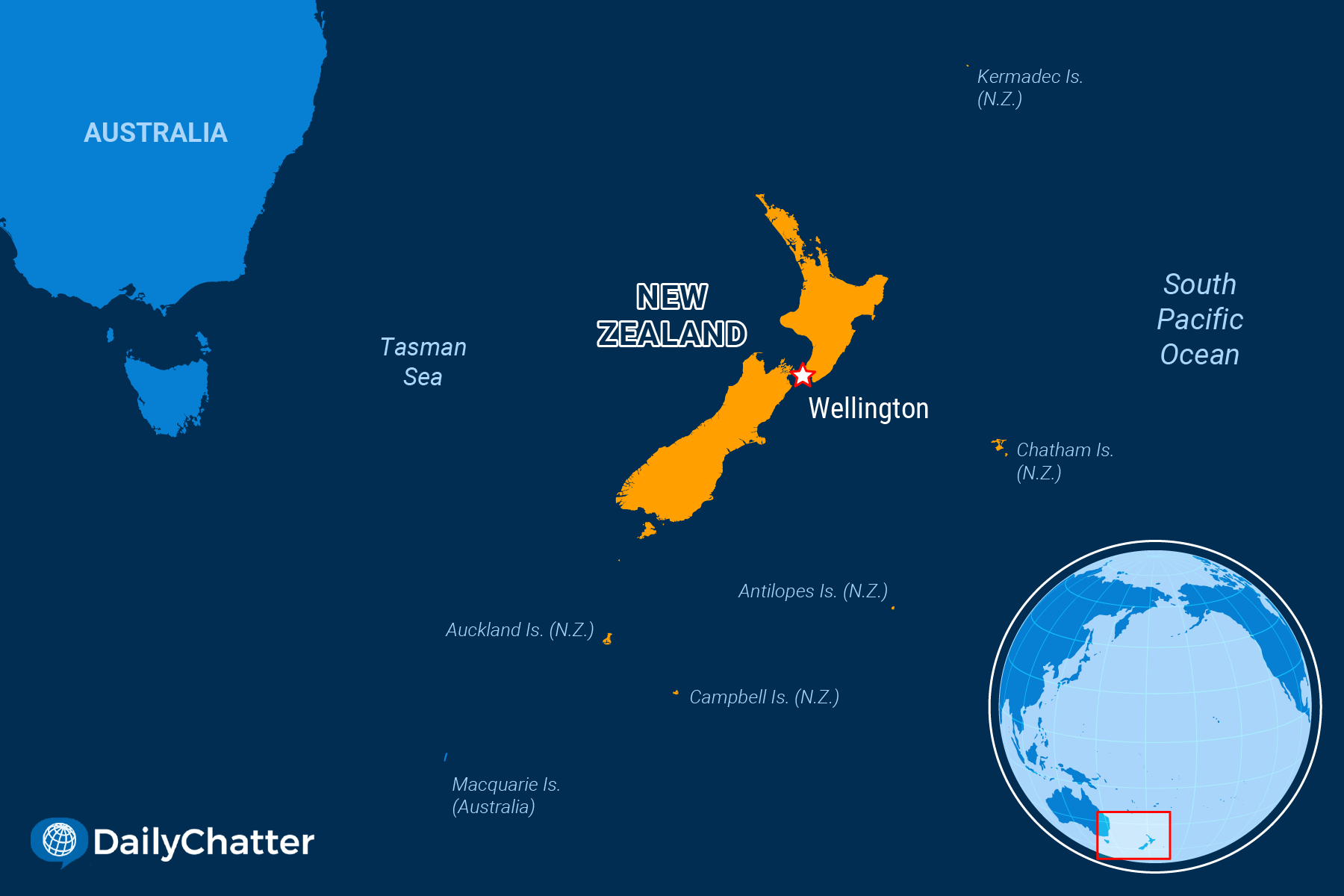

New Zealand is planning to impose a digital service tax on large multinational corporations starting 2025, a move that comes amid delays among nations working to overhaul international tax rules, the Wall Street Journal reported.

The new levy will impose a three percent tax on multinationals that make more than $812 million annually from global digital services and earn at least $2.1 million a year from providing digital services in New Zealand.

It will specifically target firms that profit from New Zealand users of social media platforms, Internet search engines and online marketplaces. The levy is expected to generate more than $130 million in four years.

The bill, to be introduced later this week, is a response to the slow pace of creating new international tax rules for big multinationals that operate worldwide.

In 2021, countries reached an agreement on a global tax plan to determine how multinationals should be taxed worldwide. However, talks have been slow and most nations decided to postpone the first part of the tax agreement by a year following a recent meeting in France.

The implementation of the first phase of that agreement has already been moved to 2025.

New Zealand officials noted that while they support the global deal, they are “not prepared to simply wait around until then to find out.”

Meanwhile, Canada plans to impose a digital service tax at the beginning of next year, with lawmakers cautioning that they can’t support an extended pause on digital levies.

Subscribe today and GlobalPost will be in your inbox the next weekday morning

Join us today and pay only $32.95 for an annual subscription, or less than $3 a month for our unique insights into crucial developments on the world stage. It’s by far the best investment you can make to expand your knowledge of the world.

And you get a free two-week trial with no obligation to continue.