The One-Percenters

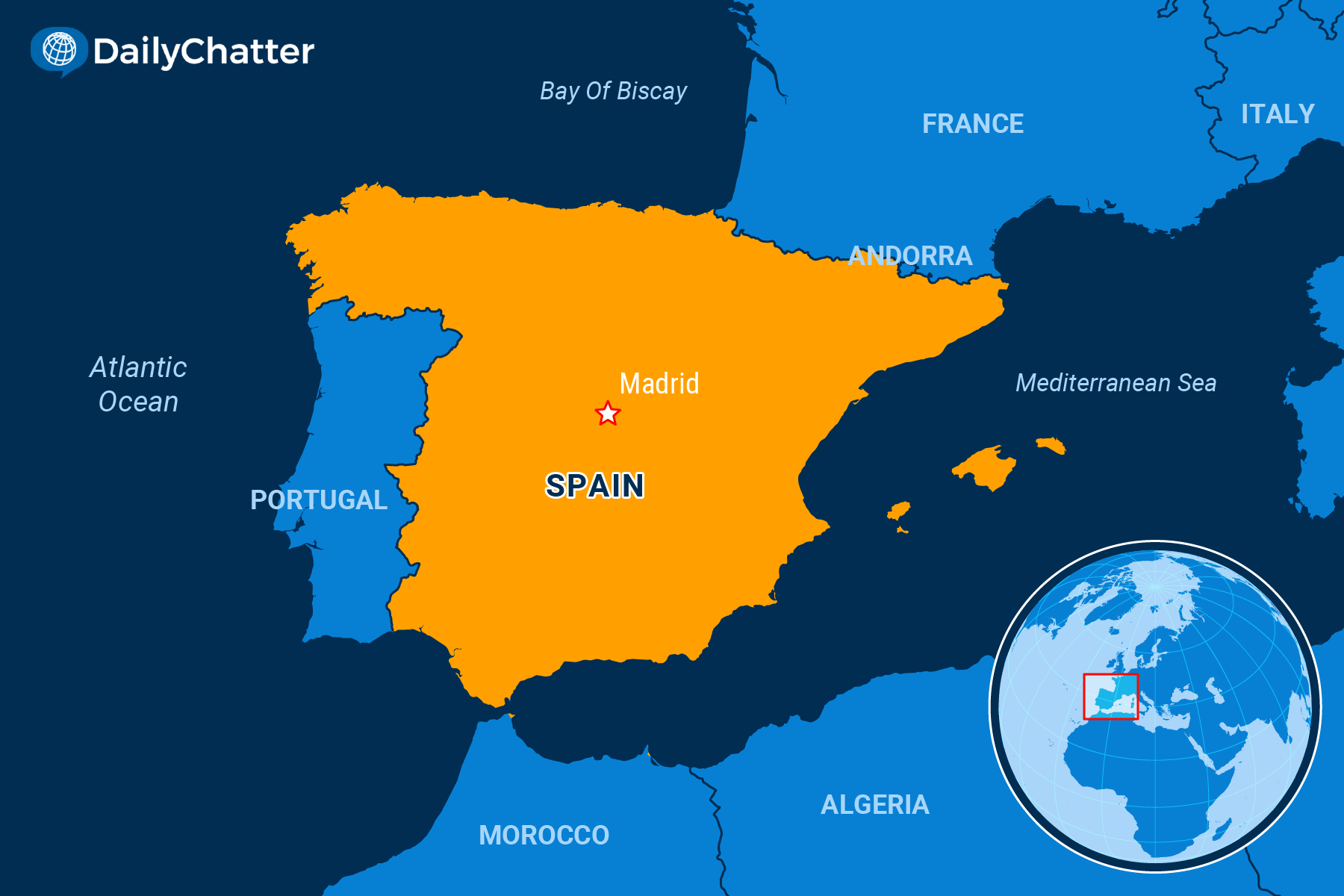

The Spanish government plans to introduce a temporary tax rate hike on the country’s wealthiest one percent starting next year in an effort to alleviate the impact of soaring inflation and rising costs, the Associated Press reported.

Officials in the Socialist-led coalition government said the new levy will target only the country’s millionaires. They added that the increase in tax revenue will be used to alleviate hardships brought by rising prices for food and energy.

Details of the plan are still being ironed out, but the move would make Spain one of the first countries to target the rich to offset the cost-of-living crisis, according to Bloomberg.

The current top rate of income tax for those earning more than $290,000 a year is 47 percent. The highest capital gains tax rate is 26 percent.

However, regional governments in the country – some of them run by the conservative Popular Party – have been cutting taxes, saying the reduction will promote growth.

Meanwhile, Unidas Podemos (United We Can), the Socialists’ junior coalition partner, is pushing to make the new millionaire tax permanent.

At the same time, Prime Minister Pedro Sanchez is also planning to introduce a windfall tax on banks and energy companies that would help pay for $29 billion of measures to blunt the impacts of inflation.

Subscribe today and GlobalPost will be in your inbox the next weekday morning

Join us today and pay only $32.95 for an annual subscription, or less than $3 a month for our unique insights into crucial developments on the world stage. It’s by far the best investment you can make to expand your knowledge of the world.

And you get a free two-week trial with no obligation to continue.