The Power in Numbers

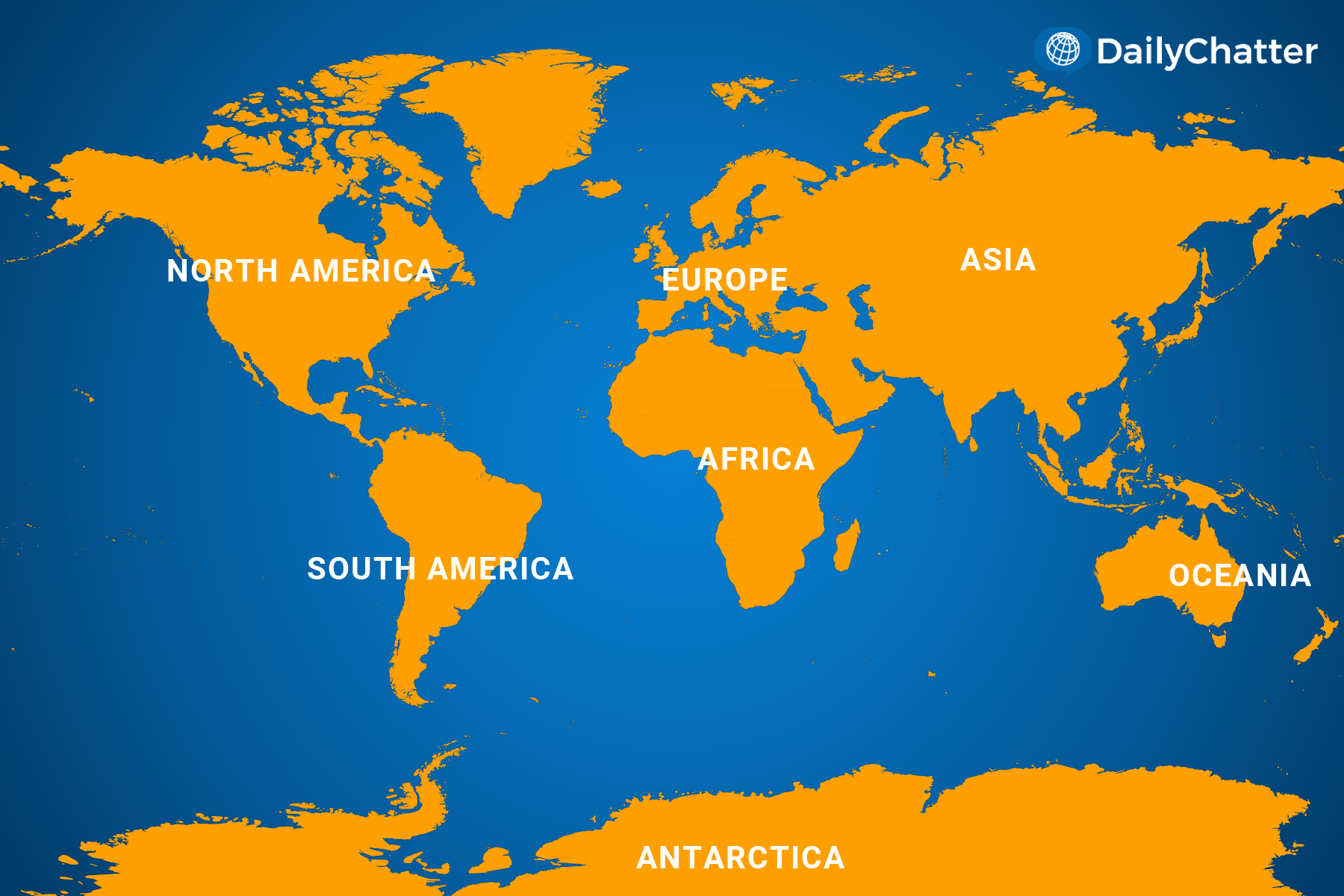

An economist from Goldman Sachs coined the term BRICS in 2001 as an acronym for Brazil, Russia, India, China, and South Africa. As the Library of Congress described it, these developing countries were becoming more important to the global economic order at the time.

Twenty-two years later, the BRICS club is adding six new countries – Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, and the United Arab Emirates. But the jury is still out on whether those members of BRICS other than China have gained standing worldwide.

That doesn’t mean they aren’t trying, though.

As Washington Post columnist Ishaan Tharoor wrote, BRICS members are seeking to replace the US-dominated world order or at least increase their clout. From their perspective, they have little choice in the matter if they want to flourish.

The BRICS group’s agenda is not absurd, either, analysts added. Together, for instance, the 10 members’ gross domestic product surpasses that of the seven most advanced industrial democracies, noted geopolitical strategist Ian Bremmer in Nikkei Asia. The countries also have deeply interconnected economic and political links, added the New York Times.

However, some BRICS members – think Egypt and Saudi Arabia – also depend on the US economically and militarily. Furthermore, as CNBC reported, Russia has suffered mightily for challenging the West since invading Ukraine, suffering crippling sanctions and military setbacks due to American and European military support for the Ukrainians.

Debates within the BRICS group about dumping the American dollar for alternative currencies are representative of the hurdles that the organization faces. The widespread use of the US currency in world trade is a cornerstone of the world order. BRICS countries often use the greenback rather than their own currencies because dollars are more liquid than, say, the Ethiopian birr.

Doing so gives the US a strategic advantage worldwide, however. The US can print highly valuable dollars whenever it wants. The problem for BRICS members is that they are highly vulnerable to increases and decreases in the dollar’s value, interest rate hikes and cuts, and other policies with far-reaching consequences made in faraway Washington, DC.

India and the UAE recently decided to trade in Indian rupees rather than dollars to bypass this situation, for example, reported the Hindu.

It won’t be so easy to ditch the dollar, however, Al Jazeera warned. BRICS doesn’t have a single central bank nor do its members share legal or financial systems. Most importantly, it would be hard to create a new, widely used currency that isn’t tied to China, the largest BRICS economy. BRICS members don’t necessarily want to trade their dependence on the US for reliance on China.

Still, they are talking and thinking about it.

Subscribe today and GlobalPost will be in your inbox the next weekday morning

Join us today and pay only $32.95 for an annual subscription, or less than $3 a month for our unique insights into crucial developments on the world stage. It’s by far the best investment you can make to expand your knowledge of the world.

And you get a free two-week trial with no obligation to continue.